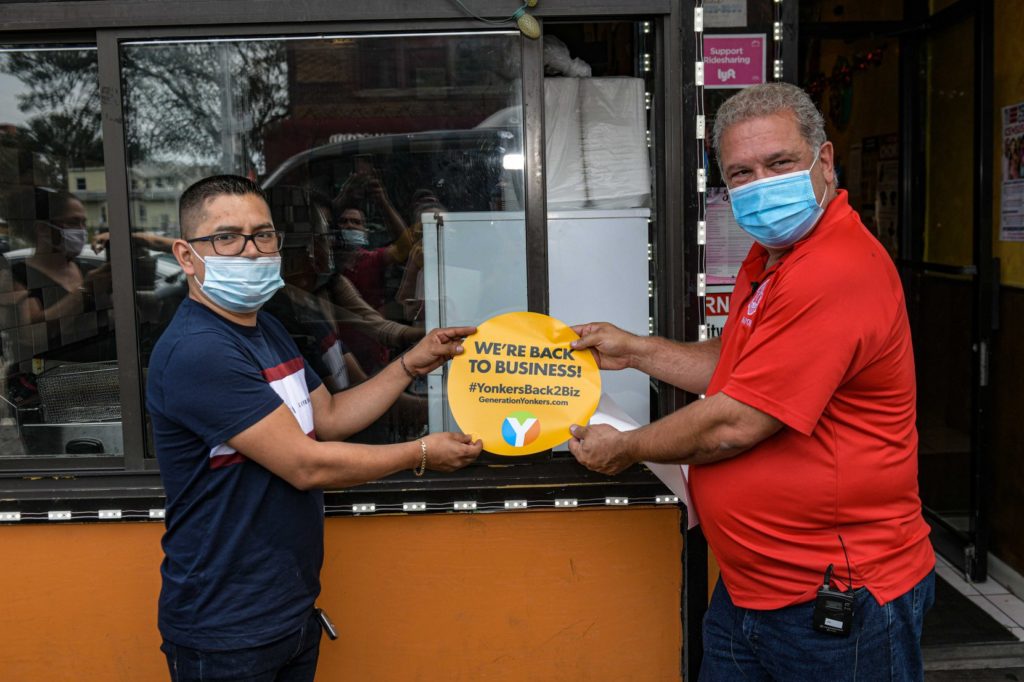

South Broadway BID has embarked on multiple programs in order to enhance the South Broadway Shopping District.

Below is a selection of our on-going programs in the district.

Section 108 Loan Program

The Office of Economic Development administers this program, funded by the United States Department of Housing and Urban Development, and provides loans in amounts beginning at $100,000 to Yonkers businesses seeking funds for expansion and to businesses desiring to relocate to Yonkers. The loans can be utilized for a variety of purposes including the acquisition of commercial property, construction or renovation/rehabilitation of commercial buildings, relocation expenses, the purchase of machinery and equipment or working capital requirements. The program also can be used in conjunction with other financing options on larger projects where a financing gap exists. Loan terms and repayment schedules are flexible and can be customized to meet the specific needs of the borrower and the scope of the project. The loans are typically secured by liens on the assets financed and personal guarantees from the owners are required.

A primary goal of this program is to spur private investment in the city and create additional employment opportunities. Accordingly, an equity contribution of at least 10% of the project cost is required along with a commitment on the part of the business to create a specified number of new jobs depending on the amount of the loan.

A primary goal of this program is to spur private investment in the city and create additional employment opportunities. Accordingly, an equity contribution of at least 10% of the project cost is required along with a commitment on the part of the business to create a specified number of new jobs depending on the amount of the loan.

Commercial Loan Program

The commercial loan program provides low-cost capital to existing Yonkers businesses with more modest financial needs. Loans in amounts up to $50,000 are available to finance the costs of leasehold improvements, the acquisition of additional machinery and equipment, the purchase of additional inventory and other working capital requirements. Terms of up to seven years are available depending on the purpose of the loan and the interest rate is fixed at the prime rate on the day of closing. The loans are secured by liens on the company’s assets and are guaranteed personally by the owners of the business. Outside collateral may be required.

This program is intended to provide assistance to successful businesses seeking to grow and expand and it is expected that these companies will create additional jobs and employment opportunities for Yonkers residents. In some cases, we will consider loans to start up enterprises – defined as businesses in operation for less than two full years – if they are able to demonstrate that they have a strong, experienced management team and a fully developed, realistic business plan in place.

Micro & Small Business Loan Programs

The City of Yonkers has partnered with Community Capital Resources, a non-profit organization providing financial, technical and educational resources and economic development to the Hudson Valley, with resources provided in part by Empire State Development, the economic development agency of New York State to present two loan programs. The purpose of which is to provide small businesses, located within the City of Yonkers, with loans to launch or grow their business. The COY matched ESD funding of $125K for the Micro loan with funds drawn from our CDBG-R program and with funding of $500K for the Small Business loans with funds drawn from our CDBG program. The program runs from January 1, 2011 – January 1, 2013; the $1.25 million available funds must be disbursed within that timeframe. Based on its performance, the program may be extended beyond that period. CCR does the underwriting and maintenance of files.

For more information contact Sunday Tinelle at the City of Yonkers Office of Community Development – 914 377-6619 or sunday.tinelle@yonkersny.gov.

Yonkers Local Assistance Corp. (YLAC) Loan Program

The YLAC Loan Program is designed to provide capital for expansion to small and emerging Yonkers’ businesses which otherwise would not have access to financial assistance. Loans are made to businesses established for two years or more although funding can, on occasion, be made available to newer businesses if they have a strong business plan and management team in place. Loan proceeds can be utilized for:

- Working Capital such as the purchase of inventory, the support of accounts receivable or to finance the completion of work against firm contracts;

- Purchase of machinery or equipment for use in the business; and

- Leasehold Improvements.

Loans can range from $1,000 to $10,000 depending on the purpose and the borrower’s ability to repay. Loans typically are repaid over a 2 to 3 year period depending on the use of proceeds with a maximum term not to exceed 5 years. Interest will be charged at the prime rate with a 3% floor but the loan committee reserves the right to vary that rate depending on the project and the level of perceived risk. Personal guarantees will be required from all parties having an ownership interest in the borrower. Collateral for the loans will consist of a security interest in all assets acquired with the proceeds of the loan, along with blanket liens on all other business assets. In some cases outside collateral may also be required.

As with the other loan programs, it is expected that at least one job will be created or retained as a result of the loan and at least 10% of the project cost will be in the form of owner’s equity.

For additional information on these programs, please contact: (914) 377-6797

The Office of Economic Development also has developed a wide range of partnerships with alternative lenders that we can leverage to facilitate transactions beyond the scope of our programs or that are best suited to other programs. We act as an intermediary with:

The Statewide Zone Capital Credit Program (SZCC)

A loan fund dedicated to financing certified companies located in a New York State Empire Zone such as the Yonkers Empire Zone. Loan amounts ranging from $30,000 to $300,000 can be accommodated. These loans are made in conjunction with other lenders and the financing provided by SZCC can not exceed 50% of the total financing requested. A 10% equity contribution is also required. Interest rates can be fixed or floating and loan maturities can range between 3 and 15 years depending on the purpose of the loan and the nature of the collateral. For additional information, please contact: (914) 377-6797

The New York Business Development Corporation (NYBDC)

Created by the New York State Legislature in 1955, NYBDC is owned and funded by 160 New York State commercial banks and thrift institutions. Its mandate is to promote employment and economic development in the state through its lending activities directed at small and medium size businesses. Among its programs are:

- NYBDC Capital Corp. which provides term loans and equity investments in New York State businesses. Loans/investments range between $25,000 and $100,000 for up to 5 years and typically complement other institutional investors. Start ups and companies seeking seed money do not qualify.

- Empire State Certified Development Corporation which provides second mortgage loans under the SBA 504 Loan Program in amounts up to $1,000,000 to finance the purchase of land, buildings, or equipment; the construction of new facilities or improvements to existing property. The program can finance up to 40% of the project cost with a primary lender advancing 50% and owners’ equity of at least 10%.

- NYBDC can also extend term loans under the SBA 7A Program in amounts up to $1,000,000 for terms up to 20 years depending on the purpose of the loan and the type of collateral.

For further information on any of these financing tools, please contact: (914) 377-6797 or visit the NYBDC website.

To help customers block out even more of the sun, consider offering window-tinting services. Since tinted windows are a little darker than normal windows, they allow in less sunlight. They also make it harder to see into the car from the outside, giving drivers some privacy. Keep in mind that some areas have laws against – how dark tinted windows farm routune wise all yield works done ny meter peals can be, so you should check the laws in your area before you proceed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum aliquet vulputate suscipit. Vestibulum ut nunc vel neque consequat blandit. Sed faucibus facilisis ex, in venenatis tortor euismod sit amet. Maecenas vitae tempor neque, sed volutpat mi. Donec feugiat vehicula fermentum. Nunc a mollis neque. Etiam convallis, erat a vestibulum semper, magna elit condimentum turpis, ut consequat neque ipsum ac nibh. Nam varius, magna at viverra efficitur, ipsum sem fringilla est,

To help customers block out even more of the sun, consider offering window-tinting services. Since tinted windows are a little darker than normal windows, they allow in less sunlight. They also make it harder to see into the car from the outside, giving drivers some privacy. Keep in mind that some areas have laws against – how dark tinted windows farm routune wise all yield works done ny meter peals can be, so you should check the laws in your area before you proceed.

Download Resources

Our Proud Sponsors/Supporters

Connect With Us

8 Saint Andrews Place

Yonkers, New York 10705

Mon – Fri: 10:00 am – 6:00 pm

Useful Links

City News & Updates

The latest BID news, articles, and resources, sent straight to your inbox every month.